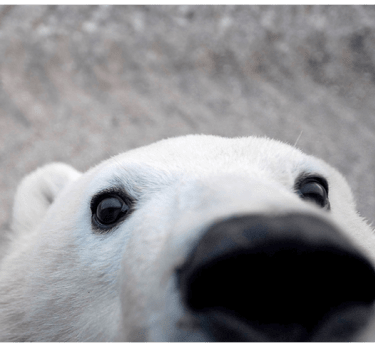

Photo: Emily Ringer

Legacy Giving

The Arctic Circle Legacy Society honors our supporters who have generously included Polar Bears International in their estate plans.

Ways to give

Appreciated Securities

Donating appreciated securities like stocks, bonds or mutual funds can be a great way to give while providing additional tax benefits. To learn more, speak to your financial advisor.

Retirement Funds

Whether donating retirement funds during your lifetime, or as part of your estate planning, these assets can be a tax-efficient way to support causes that you care about. To learn more, speak to your financial advisor.

Gifts in Your Will

We have partnered with Giving Docs, an independent third-party online estate planning platform, to make it easy and simple to write your will from the comfort and privacy of your home, at no cost to you. Giving Docs is a resource for U.S. Residents only.

Life Insurance Payments

You can help support polar bear conservation by naming Polar Bears International as a beneficiary to your retirement plans, life insurance policies, donor advised funds or commercial annuities. Contact your financial planner to learn more about this simple and flexible gift option.

Val Beck

Polar Bears International Donor and Founding Board Member.

“We have seen for ourselves the ominous link between the survival of polar bears as a species and our own. That’s why our estate plans include a bequest to Polar Bears International. We believe that preserving polar bears is more than about saving an especially impressive species. It’s also a critical step toward preserving the planet for generations to come.”

— Val Beck

Frederica Gamble

Polar Bears International Donor and Founding Board Member.

“How can we imagine a world without polar bears for our children and our grandchildren. I can’t fathom that. I support Polar Bears International because it is the only organization solely focused on the conservation of polar bears. It is also of a size that a donor can make a difference. I feel like I make a difference.”

— Frederica Gamble

Reach Out

Our team would be happy to provide you with more information about how to create a lasting and meaningful legacy, how you can further your financial and philanthropic goals, and answer any additional questions you may have.