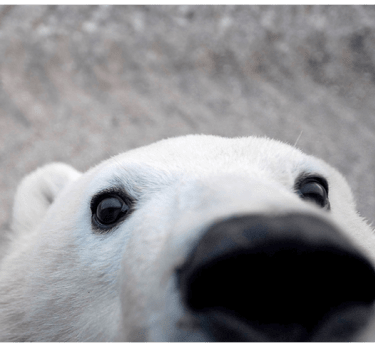

Photo: Jenny Wong

Donor-Advised Funds

Support Polar Bears International with a gift from your Donor-Advised Fund today!

A donor-advised fund (DAF) is an increasingly popular way to make a charitable gift. DAFs can provide you with immediate tax benefits while making your charitable giving easier. Here are three simple ways you can make a gift through your DAF.

1. Give via DAFpay

If you are a US Resident, you can access Giving Docs to make your gift online with DAFpay. Learn more about our partnership with Giving Docs and access estate planning tools for free.

2. Give via DAFDirect

If you have an existing fund with Fidelity Charitable, Schwab Charitable, or BNY Mellon, you can make your gift online using the DAFDirect tool below.

3. Work directly with your fund administrator

Contact your donor-advised fund administrator to recommend a grant today. Here is relevant information that your administrator may require to process your grant.

Tax Info:

United States & International

Polar Bears International

P.O. Box 3008

Bozeman, MT 59772

Federal Tax ID Number: 77-0322706

Canada

Polar Bears International - Canada

PO Box 4052, 1155 Main Street, Station B

Winnipeg, MB R2W 5K8

Canadian Charity Registration Number: 862722279 RR0001

Did you know that you can create a succession plan for your Donor-Advised Fund? You can select the option that best suits your philanthropic and financial goals to support Polar Bears International. Just contact your donor-advised fund administrator to discuss further.

If you include Polar Bears International in your legacy planning, please let us know and be sure to include our legal name, address, and identification number.

If you have any questions, please contact our fundraising team at fundraising@pbears.org.